There’s a bit more uncertainty in the markets these days. Inflation has remained stubbornly persistent, calling into question when the Federal Reserve will cut interest rates. Add in rising tensions in the Middle East and the upcoming U.S. presidential election, and we could be entering into a more turbulent economic period.

Investors seeking a safety net for turbulent times have many options. Pipeline companies Enbridge (NYSE: ENB), Williams (NYSE: WMB), and Enterprise Products Partners (NYSE: EPD) stand out to a few Fool.com contributors for their ability to deliver safe dividends to their investors regardless of the market conditions. Here’s why they believe they’re great energy dividend stocks to buy amid the current uncertainty.

Enbridge just charges tolls

Reuben Gregg Brewer (Enbridge): The big problem with oil and natural gas stocks is the huge impact that commodity prices have on the sector. But there’s one niche that sidesteps the inherent ups and downs. That’s where you’ll find Canadian midstream giant Enbridge and its huge 8% or so dividend yield.

The key is that the midstream sector is made up of energy infrastructure like pipelines, storage, and transportation assets. This infrastructure is large and costly to build, but once it is in place it becomes vital to both upstream (energy producers) and downstream (chemical and refining) companies. They are happy to pay companies like Enbridge regular and reliable fees for the use of their assets, which allow oil, natural gas, and the products into which they get turned to be easily moved around the world. Notably, Enbridge is one of the largest midstream companies in North America.

While energy prices can fluctuate wildly, demand for energy, which drives demand for Enbridge’s midstream assets, tends to be very stable over time. After all, energy is the foundation on which modern society is built. Thus the prices of oil and natural gas aren’t all that important to Enbridge’s dividend-paying ability. On that note, investment-grade-rated Enbridge has increased its dividend annually for 29 consecutive years, and its distributable cash-flow payout ratio of 65% is right in the middle of its target range. If you are looking for dividend stocks in the energy patch, Enbridge should be able to keep rewarding you well regardless of how turbulent the sector becomes.

The fuel to grow its dividend

Matt DiLallo (Williams): Williams has proved it can deliver a reliable dividend in various market conditions. The natural gas pipeline giant has paid dividends for 50 consecutive years. While the company hasn’t increased its payment every year, it has steadily risen over the decades. Williams has delivered 6% compound annual dividend growth since 2018.

The natural gas infrastructure giant currently yields 5%, well above the S&P 500 index’s dividend yield of 1.4%. That monster payout is on an extremely firm foundation. Williams generates very stable cash flow backed by long-term contracts and government-regulated rate structures (it has delivered 32 straight quarters of meeting or exceeding consensus earnings estimates). The company produced enough cash to cover its dividend by a comfy 2.4 times last year. That enabled it to retain money to fund expansion projects and strengthen its balance sheet. Its leverage ratio was 3.6 times at the end of last year, a 25% improvement from 2018’s level.

The company’s strong post-dividend free cash flow and balance sheet capacity give it lots of flexibility to fund expansion opportunities. Williams is investing in 20 high-return expansion projects to grow its natural gas transmission business, gathering and processing capacity, and Gulf of Mexico operations. Projects currently under construction will drive earnings growth through at least 2027. It has over 30 additional projects under development that could extend its growth outlook into the next decade. The natural gas infrastructure company expects to grow its earnings by 5% to 7% annually over the long term.

Williams routinely supplements organic growth with acquisitions. It has made $6.1 billion of acquisitions since 2021 to enhance its portfolio and growth profile. It has plenty of financial flexibility to continue making accretive acquisitions as opportunities arise.

With a rock-solid financial position and visible growth on the horizon, Williams stands out as a very safe energy stock to hold during turbulent times.

A steadily rising high-yielding payout

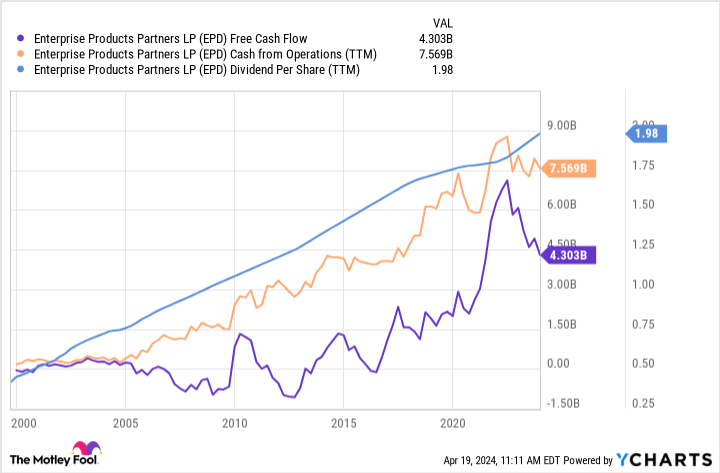

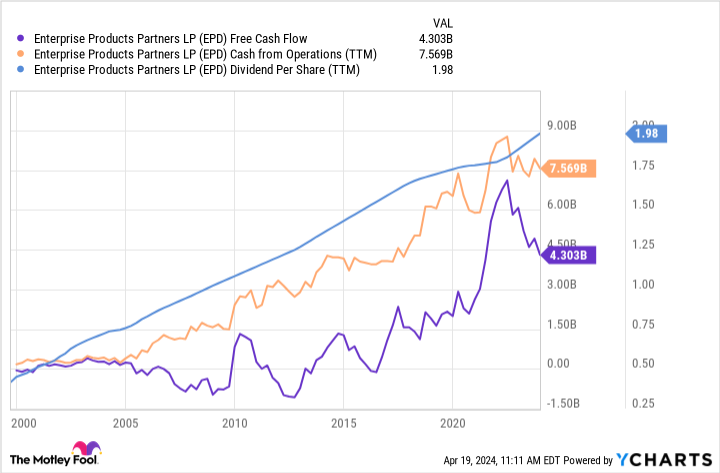

Neha Chamaria (Enterprise Products Partners): No oil and gas stock is immune to the volatility in oil and gas prices, but some can still thrive and reward their shareholders with bigger dividends even during turbulent times. Enterprise Products Partners is one such stock, and its track record is proof of its dividend’s reliability and stability: Its cash flows have only grown over time, and the company has increased its dividend every year for 25 consecutive years.

Enterprise Products’ business model, of course, is an important factor behind its reliable dividends. As a midstream energy infrastructure company, Enterprise Products provides services such as storage and transportation of natural gas, natural gas liquids, crude oil, refined products, and petrochemicals to producers and consumers under long-term, fee-based contracts. That means the company earns a fee for these services regardless of where oil and gas prices are, which is why its cash flows are stable and can support dividends at all times.

Enterprise Products is going strong right now, having generated $7.5 billion in distributable cash flow in 2023, which could cover its dividends comfortably by 1.7 times. Put simply, the company has ample cash to cover its dividends and grow them. Enterprise Products entered 2024 with $6.8 billion of organic projects under construction, including two natural gas processing plants in the Permian basin which are expected to be complete this year and should start adding to the company’s cash flow. With Enterprise Products focused on growing its cash flow and committed to returning capital to shareholders, the 7.2%-yielding stock makes for a no-brainer energy dividend stock to own for turbulent times.

Should you invest $1,000 in Enbridge right now?

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $518,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of April 15, 2024

Matt DiLallo has positions in Enbridge and Enterprise Products Partners. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in Enbridge. The Motley Fool has positions in and recommends Enbridge. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

3 Safe Energy Dividends for Turbulent Times was originally published by The Motley Fool