The latest tech sell-off has been hard on many companies, including Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). At its high, Alphabet attained a valuation worth over $2.5 trillion. Now, it sits at $2 trillion. That’s a huge amount of value erased from one of the world’s top tech companies in just a few weeks. But was the sell-off justified for Alphabet?

Alphabet is now the cheapest stock in the Magnificent Seven cohort by far, yet it has better finances than many of the others in that grouping. As a result, I think Alphabet is a solid buy here, but there is one thing investors need to look out for.

Alphabet is less recognizable as a brand of its own than it is for the companies that are under its umbrella — Google, YouTube, and Android, among others. While that seems like a wide-ranging product lineup, the reality is that Alphabet’s business is centered around one thing: Advertising.

Alphabet derives about three-quarters of its revenue from ads, so it’s critical that it stay on top of its game in this sector. Alphabet has done this by developing various generative AI tools based on its proprietary Gemini model, which is part of the reason why it’s spending so much on AI infrastructure.

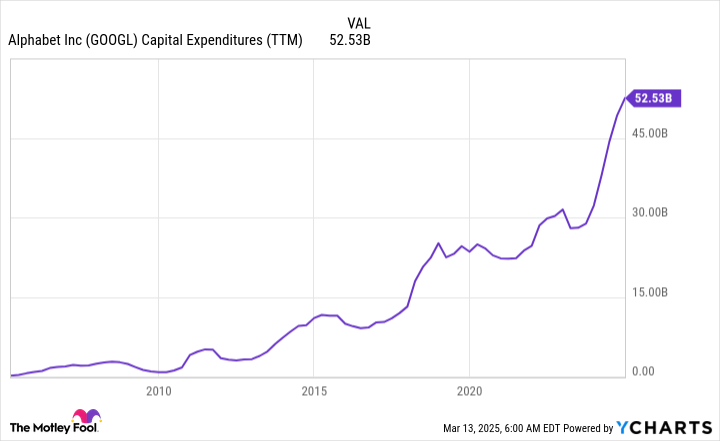

For 2025, Alphabet informed investors that they should expect around $75 billion in capital expenditures, which is by far the most money it has invested in the business.

Another reason Alphabet is spending so much is its need to build its cloud computing infrastructure. Cloud computing is a huge component of the AI arms race, as few companies want the upfront cost of buying a data center outfitted with best-in-class graphics processing units (GPUs) and then maintaining it throughout its service life. they’d rather just rent the computing power and run workloads on the cloud.

Google Cloud is a top-three player in this sector and Alphabet’s fastest-growing business unit, with revenue rising 30% year over year in the fourth quarter. The cloud computing market is growing rapidly and is still in the early stages of its buildout.

Alphabet’s great balance between a steady bedrock business (advertising) and the upsides of AI and cloud computing makes for a fantastic investment story. However, there is one negative that must be considered.

With all of Alphabet’s success comes scrutiny, and the U.S. government has investigated it for a long time to understand if it was acting as an illegal monopoly. Former President Joe Biden’s Department of Justice (DOJ) indicated that it wanted to break up Alphabet by forcing the sale of its Google Chrome browser. In a rare sign of agreement, President Donald Trump’s DOJ has maintained that same opinion and will continue pushing for the breakup of Alphabet.