Palantir Technologies (NYSE: PLTR) rose to the top as one of the premier artificial intelligence (AI) stocks. Its prowess in AI software application is almost unmatched, which is why investors are so excited.

However, alongside this excitement has come inflated expectations, and I’m worried that even if the business succeeds, the stock could fall flat on its face due to the run-up it already experienced.

Can Palantir live up to these high expectations? Or are investors in for a rude awakening?

Palantir’s software is just starting to be adopted

Palantir’s software has been integrating AI with decision-making for a long time. It started in 2003 as a company focused on providing software to the government and has since expanded into the commercial sector. Its software was developed to streamline data flows and give decision makers the best possible information.

This program is incredibly useful, especially in high-stakes scenarios (like those found in government). And Palantir’s latest product takes this to a whole new level.

Its Artificial Intelligence Platform (AIP) gives developers the tools to integrate AI throughout a business, whether it be in apps for certain purposes or using AI to drive workflows and improve productivity.

This is exactly what many companies are looking for because AI is mostly being used as a tool on the side rather than directly integrated into workflows.

AIP has been a hit on the U.S. commercial side of the business, driving a second-quarter revenue increase of 55% to $159 million among these clients. Perhaps even more impressive was that its U.S. commercial customer count rose 83% from a year ago to 295.

This shows that there have been relatively few adapters of Palantir’s software, but there’s a reason for that: its cost. If we annualize the revenue and divide it by customer count, that gives an annual contract value of around $2.16 million. That’s a very expensive software package, and it limits potential clientele.

Still, that’s only a fraction of Palantir’s business. Its total second-quarter revenue was $678 million, up 27% from last year.

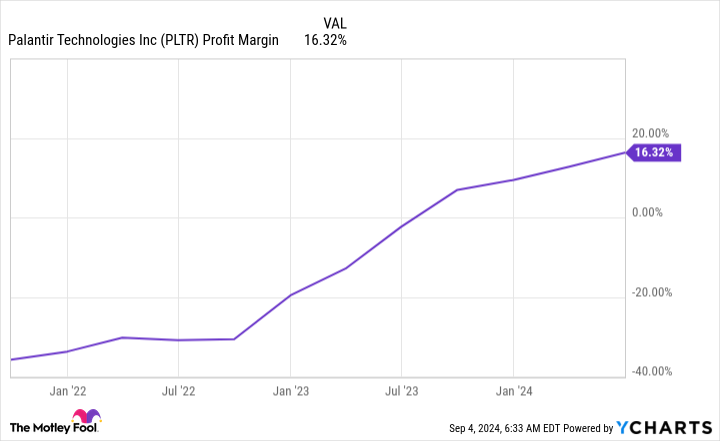

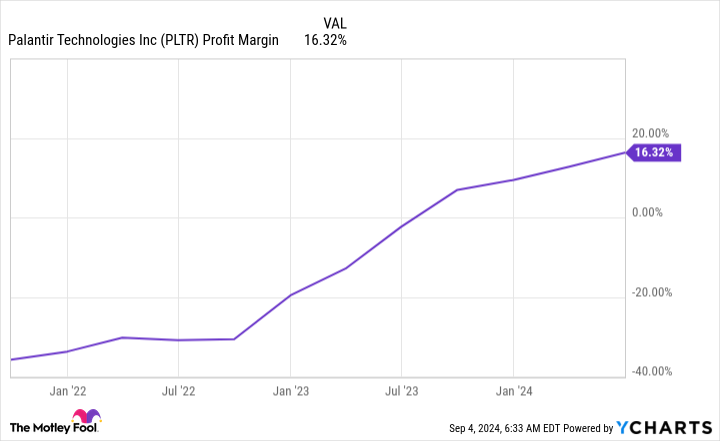

Although Palantir is a growing software company, it still knows how to turn a profit (a lesson it can teach some of its peers). The second quarter saw record profit margins, with earnings per share totaling $0.06.

But all of those great metrics come at a hefty price, which is why I’m not keen on buying Palantir’s stock right now.

Even if the business succeeds, the stock could struggle

Palantir is still working on achieving maximum profitability, so using an earnings-based valuation metric doesn’t do it justice. (The stock trades at 86 times forward earnings.)

Instead, it’s better to project what Palantir’s valuation could be if it achieved margins similar to those of other mature software companies. Adobe is the industry standard for software companies, and its average profit margin over the past five years was 30%.

We need to establish a growth rate for the business. Wall Street analysts expect 24% growth in 2024 and 21% in 2025, but if we give Palantir the benefit of the doubt and say it can maintain its second-quarter growth rate of 27% for five years, that would give it annual revenue of $8.19 billion.

If it converts 30% of that into net income, it would generate $2.46 billion in profits. We get its ratio of price to five-year forward earnings by dividing its current market cap by this hypothetical profit.

This figure comes in at 27.8 times five-year forward earnings. What does Adobe trade for right now? It’s at 31.4 times forward earnings.

So Palantir must greatly exceed Wall Street expectations and achieve industry-leading profit margins for five years, and only then will it be valued at the same price another company is right now.

This just shows the extreme expectations built into the stock, which is why I’m not a buyer at these prices. There are too many other companies’ shares that can be bought for a reasonable price to justify buying Palantir right now, even if the underlying business will succeed over the same time period.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $656,938!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 3, 2024

Keithen Drury has positions in Adobe. The Motley Fool has positions in and recommends Adobe and Palantir Technologies. The Motley Fool has a disclosure policy.

Can Palantir’s Stock Live Up to Lofty Expectations? was originally published by The Motley Fool