When it comes to dividend investing, one could do worse than beverage giants The Coca-Cola Company (NYSE: KO) and PepsiCo (NASDAQ: PEP). Both companies have two key traits that dividend investors crave: Predictability and high yields.

Coca-Cola and Pepsi are two of the most predictable dividend payers on the market. Both companies have paid and increased their dividends for more than 50 years (61 years and 51 years, respectively), earning them the prestigious title Dividend King.

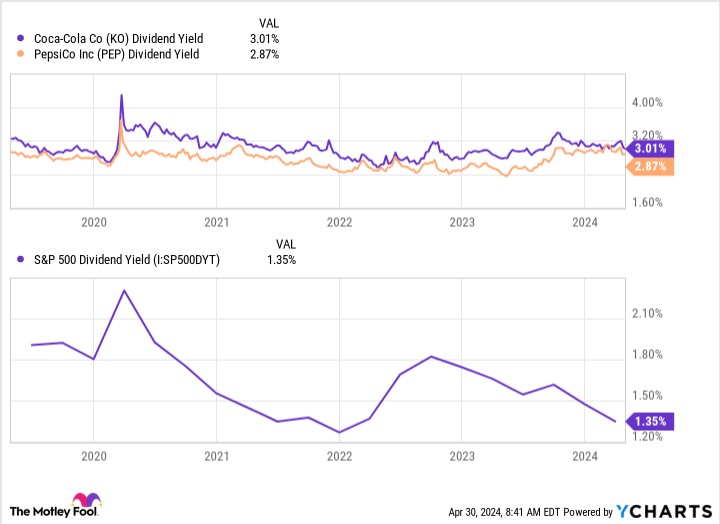

Coca-Cola and Pepsi are also both considered to have high-yield dividends — a yield is how much investors get back compared to the value of the investment. The yield for Coca-Cola is over 3%, whereas the yield for Pepsi is just below that. But as the chart below shows, the yield for both companies is more than double the average for the S&P 500.

However, if there’s a knock against Coca-Cola and Pepsi as dividend investments, it’s in their ability to grow their dividends.

In February, Coca-Cola announced that it was raising its dividend by about 5%. For its part, Pepsi’s latest raise (also announced in February) was better at 10%. Therefore, they are growing dividends, but it’s fair to wonder if raises in future years will be as big as these.

Many investors look at a company’s cash flow and compare it to dividend payments to get a sense of how much a dividend can grow over time. In Coca-Cola’s case, this year it expects full-year free cash flow of $9.2 billion, down slightly from 2023. But it paid $8 billion in dividends in 2023 and just raised its dividend by 5%. Therefore, future raises could be small because its dividend is eating up a lot of its current cash flow.

Pepsi is in a similar situation. It doesn’t talk about free cash flow in its earnings reports. But looking at traditional profitability metrics shows a comparable situation. In 2024, the company expects to pay dividends of $5.06 per share. In comparison, it expects $8.15 in earnings per share (EPS) this year. Therefore, it expects to pay out 62% of its earnings as dividends this year, which leaves some room for future raises. But dividend increases likely won’t outpace EPS growth.

Dividend growth is important for investors with longer time horizons. That’s why dividend investors might want to give the third biggest beverage company, Keurig Dr Pepper (NASDAQ: KDP), a look today.

Could Keurig Dr Pepper be a dividend growth stock?

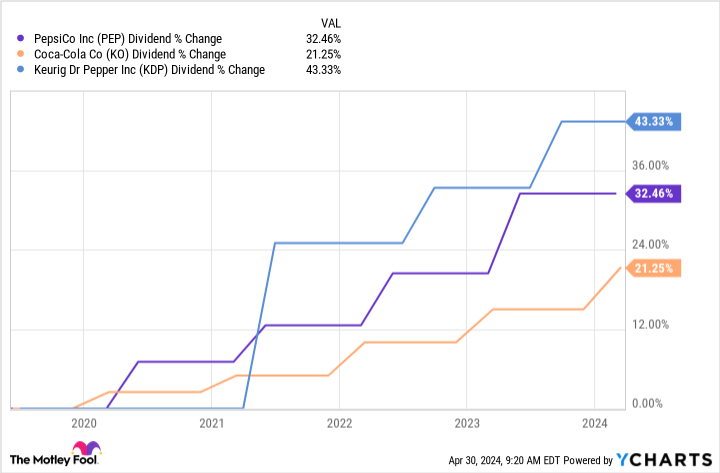

With its dividend yield of 2.6%, many dividend investors will look past Keurig Dr Pepper stock and buy shares of Coca-Cola or Pepsi instead, given the higher yields. However, Keurig Dr Pepper has increased its dividend at a faster rate over the last five years, and I believe it can do it again.

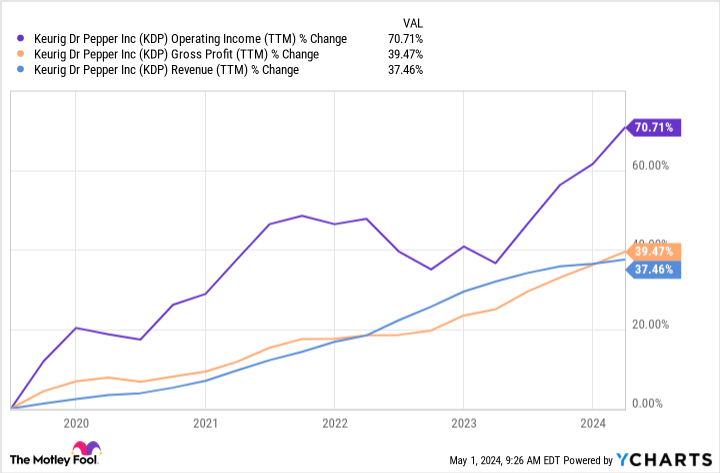

Keurig Dr Pepper just reported financial results, and its profits are finally surging after years of disappointing progress.

Over the last five years, Keurig Dr Pepper’s gross profit growth has outpaced revenue growth, which is a good thing to see. The company’s operating profit growth is outpacing progress with its gross profit, which is even better. While this is a five-year trend, the trend since the beginning of 2023 is more pronounced.

Keurig Dr Pepper’s management credits its improvements to just good old-fashioned operational discipline. What I like about this kind of improvement is that it’s not driven by external factors, which are unpredictable and perhaps not repeatable. The company can sustain its success and even further build on it.

As it is, Keurig Dr Pepper has a dividend payout ratio of just 54%, according to YCharts. That’s far lower than the payout ratios for Coca-Cola and Pepsi, which are both at 74%. This metric alone suggests that Keurig Dr Pepper has more room to grow its dividend at a faster pace than the other two. And if the company keeps growing its earnings at a faster pace, then it will have even more room.

Keurig Dr Pepper won’t necessarily be the top-performing stock on the market year in and year out — it’s a mature business and growth is modest. But from a dividend perspective, I believe Keurig Dr Pepper can supply investors with consistency, a generous yield, and above-average dividend growth for the next several years and beyond.

Should you invest $1,000 in Keurig Dr Pepper right now?

Before you buy stock in Keurig Dr Pepper, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Keurig Dr Pepper wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of April 30, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Dividend Investors Love Coca-Cola Stock and Pepsi Stock. But This Other Beverage Stock Might Be Poised for Better Dividend Growth. was originally published by The Motley Fool