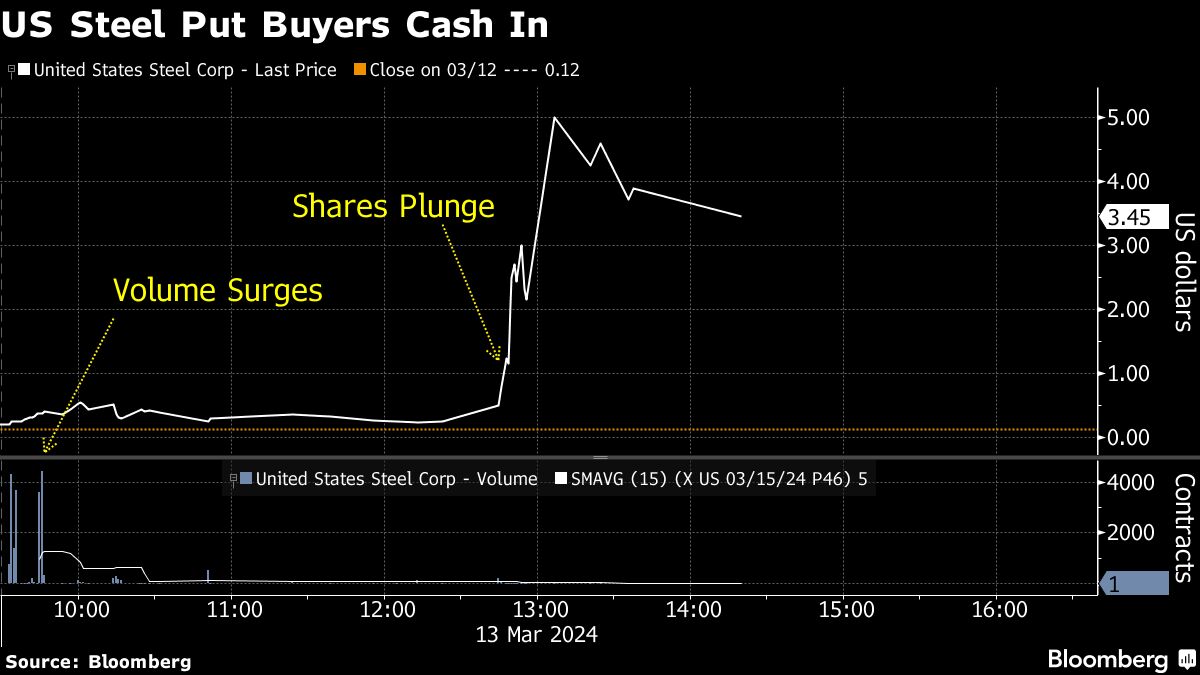

(Bloomberg) — Traders who snapped up bearish United States Steel Corp. options early on Wednesday stand to make more than 10 times their money after the stock plunged following a report that President Biden plans to express concerns about a proposed takeover by Japan’s Nippon Steel Corp.

Most Read from Bloomberg

More than 20,000 contracts — allowing the holders to sell 2 million shares of the Pittsburgh-based steelmaker at $46 — traded early Tuesday for an average of just under $0.31 each. The buying appeared to come from customers, as opposed to market makers or banks, according to data compiled by Bloomberg. The stock was trading just above that level, so the options, which are set to expire Friday, had little value.

But following the report by the Financial Times, shares plunged as much as 15% to $39.86, with small amounts of those options trading as high as $5 each. With shares trading at $41.65, on paper they would be worth $4.35 each at expiration, leaving the buyer or buyers sitting on some $8 million in profits.

Read more: US Steel Falls on Report Biden Will Voice Concern on Deal

To be sure, there were 19,000 contracts outstanding, so some of the buying may have come from traders covering a short position before expiration.

–With assistance from Alyce Andres.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.